The New Jersey Asset & Rebate Management Program (the NJ/ARM Program, NJ/ARM, or the Program) was created in 1989 as a joint investment trust under the Interlocal Services Act. NJ/ARM provides local governments in New Jersey with investment management services for capital, reserve, and general operating funds. In addition, the Program offers investment management and arbitrage rebate compliance services for tax-exempt bond and note proceeds.

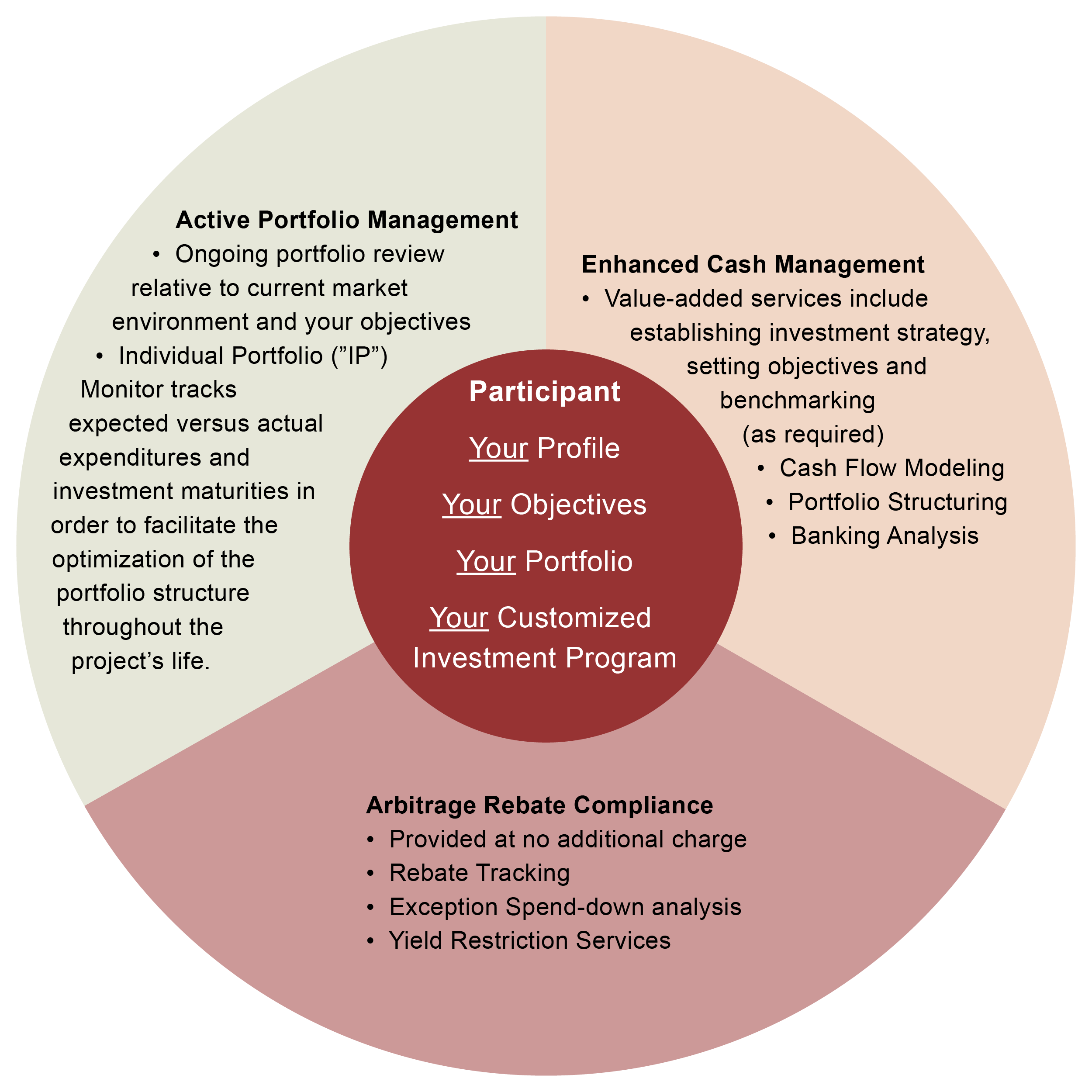

NJ/ARM offers its investors the benefit of a professionally managed investment program with multiple investment options, including the Joint Account and the Individual Portfolio.1

The NJ/ARM Joint Account provides a vehicle for local governments to pool funds for short-term investment to meet daily liquidity needs. For longer-term investment strategies, the Individual Portfolio provides for customized investment portfolios of permitted securities pursuant to New Jersey statutes.

The goals of the NJ/ARM Program are safety of principal and liquidity of the local government funds entrusted to it, as well as earning a competitive yield. The Joint Account portfolio is rated AAAm by S&P Global2 (an independent rating company), which is the highest rating available.

The Program is designed to comply with all New Jersey statutes and regulations for the permitted investment of public funds. Additionally, all securities must meet the high investment standards of PFM Asset Management3.

1 Available under a separate agreement with the investment adviser.

2 S&P Global AAAm Rating: S&P evaluates a number of factors, including credit quality, market price, exposure, and management. Please visit SPGlobal.com/Ratings for more information and ratings methodology.

3 PFM Asset Management is a division of U.S. Bancorp Asset Management Inc., NJ/ARM’s investment advisor and administrator, that services public sector clients.

-

Wire Deadline Extended!

NJ/ARM’s same-day wire transaction deadline is now 3 p.m. ET.

This enhancement gives you more time each day to move funds into or out of your NJ/ARM Joint Account, helping support better cash flow planning and more responsive financial management.

Click here to view the updated Information Statement. Please reach out to CSGEast@pfmam.com or 800.535.7829 with any questions.

Please enter your color in the box below for the top navigation bar and side navigation bar. Make sure there are no extra spaces in the box below:

| #7B797A |

Please enter your color in the box below for the login button and top left icon. Please make sure there are no extra spaces in the box:

| #E7E2E7 |

Please enter your font style below in the box.

*Make sure there are no extra spaces in the box and do not delete the box:

| Poppins, sans-serif |